In February 2023, the TaxAct class action lawsuit was filed due to alleged privacy violations by TaxAct, a tax preparation software developer. According to the plaintiffs, TaxAct is guilty of improperly sharing users’ sensitive information without their consent. As a tax preparation company, TaxAct regularly handles user information such as social security numbers (SSNs), income details, and other personal financial data.

At Sparrow, we specialize in helping individuals understand and participate in class action settlements. With our expertise, clients stay fully informed on each case and receive the right compensation they are entitled to at the right time. We have the tools and resources to help eligible class members navigate a wide range of class action lawsuits, from real estate cases to drug injury lawsuits like the recent Ozempic diabetes drug class action.

With our years of industry experience, we’ve put together this blog to provide an easy step-by-step guide to joining the TaxAct class action lawsuit. We’ll also provide an in-depth look at the case details, such as the allegations, settlement package, and timeline of action. By the end, you’ll have a comprehensive understanding of what to expect throughout the process and how to effectively claim your share.

Stay informed with these details for the TaxAct class action lawsuit:

TaxAct Company Background

Established in 1998, TaxAct Holdings, Inc. is a tax preparation software developer. TaxAct products encompass both online and desktop solutions to help individuals and businesses file their taxes. Although it is outshined by major players in the tax software market, such as QuickBooks and Netsuite, TaxAct caters to a small but loyal customer base for its affordability and user-friendliness.

Case Details: What is the TaxAct Class Action Lawsuit About?

The TaxAct class action lawsuit asserts that the company has allegedly violated privacy laws, particularly concerning sharing sensitive user data with third parties. Sensitive personal and tax data was shared with third-party advertising platforms, compromising user privacy and data transparency.

TaxAct class action lawsuit is similar to the recent Temu class action lawsuit filed in November 2023 regarding their data collection practices. As a developer of tax preparation software, TaxAct handles a substantial amount of sensitive data, including social security numbers, income details, and other personal financial information.

Allegations

The TaxAct class action lawsuit accuses TaxAct of disclosing confidential and private tax return information to unauthorized third-party advertising platforms such as Meta, formerly known as Facebook. This includes tax return types, refund amounts, filing status, and tax years, as well as personal identifiers such as names, phone numbers, and names of dependents.

Sharing such information without proper consent breaches user privacy and damages consumer trust by violating the Electronic Communications Privacy Act (ECPA). Plaintiffs argue that TaxAct misled users about the security of their information, as customers expect full confidentiality and transparency from their service. This misrepresentation constitutes unlawful, unfair, and fraudulent business practices under various California state laws.

Company’s Stance on the Case

In response to the TaxAct class action lawsuit’s allegations, TaxAct has denied that they have violated any laws or committed any wrongdoing at all. The company clarifies that it has always prioritized user privacy and security. Despite this, TaxAct has agreed to settle the lawsuit but insists that the settlement is not in any way an admission of guilt.

Settlement Details

The proposed settlement agreement includes a $14.95 million settlement fund to be distributed among eligible class members who were affected by the alleged privacy violations. On top of this, TaxAct has also agreed to allocate up to $2.5 million for Notice and Administration Costs, Attorneys’ fees and costs, and Service Awards for Settlement Class Representatives.

In addition to cash payment, TaxAct will also provide Xpert Assist services to all class members who submit a valid claim form and use TaxAct’s online do-it-yourself consumer Form 1040 tax filing product for their 2024 tax return.

Eligibility

Eligible class members can belong to two Settlement Classes:

- Nationwide Class: Encompasses individuals who used TaxAct’s online Form 1040 tax filing product between January 1, 2018, and December 31, 2022, and whose tax return listed a U.S. postal address. This class includes a California Subclass for members residing in California.

- Nationwide Married Filing Jointly Class: Covers individuals whose spouses used TaxAct’s online Form 1040 product to file jointly during the same period, with a U.S. postal address on the joint tax return. This class includes a California Married Filing Jointly Subclass for those in California.

Excluded from the TaxAct class action lawsuit are customers who exclusively used TaxAct’s download do-it-yourself consumer Form 1040 tax return filing product, TaxAct’s Professional products, or TaxAct’s online do-it-yourself business tax return filing products.

Individuals who filed a demand for arbitration against TaxAct by January 9, 2024, to arbitrate claims that would otherwise be released under the Settlement Agreement are also not eligible unless they are opt-in by submitting a timely claim form.

Compensation

If approved by the Court, the $14.95 million fund promised in the TaxAction class action settlement will cover compensation for valid claims submitted by the settlement class members. Each class member will get an estimated $18.65 each, depending on how many claims are filed until the deadline. As part of the settlement, TaxAct will also provide Xpert Assist to all settlement class members who submit a valid claim form.

Xpert Assist is a service offered by TaxAct that provides personalized tax advice and guidance over the phone from qualified tax experts. It will be provided for free to settlement class members, helping them prepare their tax returns and address any tax-related queries they may have. TaxAct has not specified for how long they will provide free access to Xpert Assist, but it may extend only for one tax year, depending on the number of claims submitted.

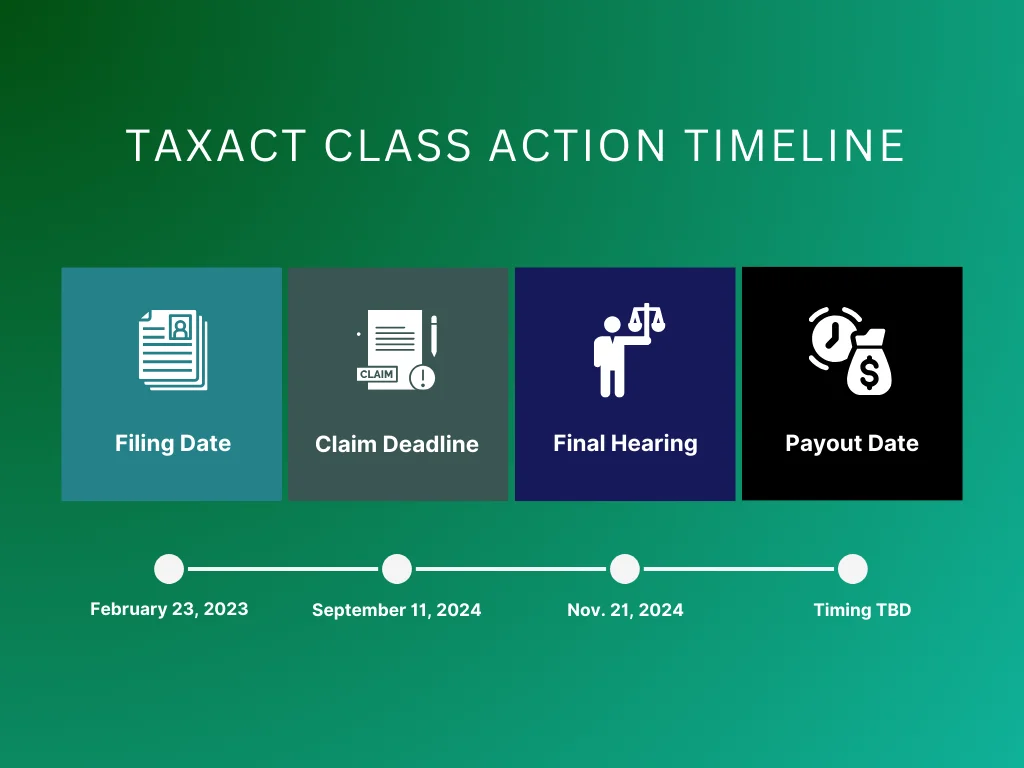

Timeline of Action

The TaxAct class action lawsuit has progressed through much of the litigation proceedings and is scheduled for final approval. Here are the key events in the TaxAct class action lawsuit:

- Filing Date: The TaxAct class action lawsuit titled Smith-Washington et al. v. TaxAct Inc., Case No. 3:23-cv-00830-VC, was filed on February 23, 2023, in the United States District Court for the Northern District of California.

- Claim Filing Deadline: The deadline to file claims is set at 11:59 PM Pacific Time on September 11, 2024. If submitted by U.S. mail, the completed and signed claim form must be postmarked by that date.

- Final Approval Hearing: The settlement’s final approval hearing is scheduled for Nov. 21, 2024, at 2:00 PM Pacific Time.

- Payout Date: Payments to eligible class members will be distributed after the final approval hearing, likely within a few months after the hearing has passed.

The deadline to file for exclusion from the TaxAct class action lawsuit is the same as the claim filing deadline, which is set by September 11, 2024, while objections and notices of intent to appear will be received until August 12, 2024.

Failure to file a claim on time will cause your compensation to be counted as part of the unclaimed settlement payments. There are a few possible ways that unclaimed settlement funds might be distributed, but in this case, they may be redistributed among the class members who file a claim on time.

How to Join the TaxAct Class Action Lawsuit

Joining the TaxAct class action lawsuit is relatively simple. Eligible class members will be notified by the Settlement Administrator that they qualify to file a claim. Here is a step-by-step of what you need to do to join this class action:

Step 1: Verify Your Eligibility

Begin by verifying your history of using TaxAct’s online do-it-yourself consumer Form 1040 tax filing product between January 1, 2018, and December 31, 2022, along with your postal address on your tax return in the United States. Eligible class members should have received either a postcard or email notice making them aware of their eligibility and class member ID number. If you think you are eligible but received neither of these, contact the settlement administrator.

Step 2: Gather Requirements

Once you have determined that you’re an eligible class member in the TaxAct class action lawsuit, start filling in the information on the claim form. It can be found on the TaxAct settlement website operated by the Kroll Settlement Administration. You don’t need to collect any other requirements, such as proof of purchase, but it may still be prudent to gather any documentation or information related to your use of TaxAct’s online do-it-yourself consumer Form 1040 tax filing product.

Step 3: Submit Your Claim

After completing the form, submit it online to the Settlement Administrator at the settlement website. You can also print it out and mail it to Smith-Washington v. TaxAct, Inc., c/o Kroll Settlement Administration LLC, PO Box 225391, New York, NY 10150-5391. If, for whatever reason, you cannot get a claim form from the settlement website, you can request one from the Administrator via email or by telephone at (833) 425-9910.

Key Takeaway

So far, TaxAct has not provided any meaningful defense of its actions, simply asserting that it has always respected users’ privacy rights. This lack of a substantial defense raises concerns about the company’s commitment to data protection and transparency. The TaxAct class action lawsuit resulting in a substantial settlement, especially considering their market share, should serve as a stark reminder of the consequences of mishandling user data.

Although the sum they estimate for each class member is only $18, this may change with time, as objections and court rulings might still change the particulars of the settlement package. It may also increase depending on how many class members opt out or neglect to join. If you are eligible for this class action, remember to file a claim before September 11, 2024, to ensure you get your compensation.

Need help in joining any class action lawsuits like this? Sparrow will help you discover eligible class action lawsuits and guide you through the process of submitting the claims. Our mission is to make class actions more accessible through a platform where you can easily find and submit claims without extensive documentation. Explore the Sparrow blog today for more resources!