Class action lawsuits ensure justice and proper reimbursement for affected parties. Unfortunately, not all settlement money reaches those intended recipients, leading to substantial unclaimed money class action settlements. This issue affects thousands of class members across the United States who miss out on their share of settlement money from various cases involving financial institutions, real estate, government agencies, and more.

At Sparrow, we specialize in class action discovery, helping individuals identify and claim their portion of settlement money. We strive to ensure that every eligible person gets their fair share of any reimbursement. Our platform is designed to streamline the process, making it easier for you to understand and engage with ongoing litigation.

Guided by our experience and expertise in handling class action settlement cases, we’ve compiled this comprehensive guide that explores the intricacies of unclaimed money class action settlements. We’ll dive deep into why funds go unclaimed, the impact on class members, and what happens to unclaimed settlement amounts. This guide is your go-to resource for navigating the complexities of unclaimed funds and ensuring you receive your refund from the institutions.

Let’s dive in!

What Is Unclaimed Money Class Action Settlements

Unclaimed money class action settlements refer to funds from a lawsuit settlement that remains unclaimed by eligible recipients. These funds arise from various cases like data breaches or banking disputes. Rightful owners may not even be aware that they’re entitled to these settlements, leaving huge amounts of money unclaimed.

Here are four impacts of unclaimed money class action settlements on the distribution process:

- Delayed Re-Distribution: Unclaimed money can stall the redistribution process, as administrators must decide how to allocate these funds appropriately. This delay affects the efficiency of fund distribution.

- Increased Administrative Costs: Managing unclaimed money often leads to higher administrative costs. Settlement administrators must spend additional resources to manage, store, and distribute these funds.

- Legal Uncertainty: Unclaimed funds can lead to legal challenges and uncertainty. Stakeholders might need help finding the best way to handle these funds, leading to potential legal actions and delays.

- Reduced Claimant Satisfaction: When funds remain unclaimed, it can cause dissatisfaction among claimants who should have received their shares. They might feel the distribution could have been handled more fairly and efficiently.

Unclaimed money class action settlements disrupt the settlement process and can lead to increased costs and legal disputes. Efficient handling of these funds is crucial to maintaining the integrity and purpose of class action settlements.

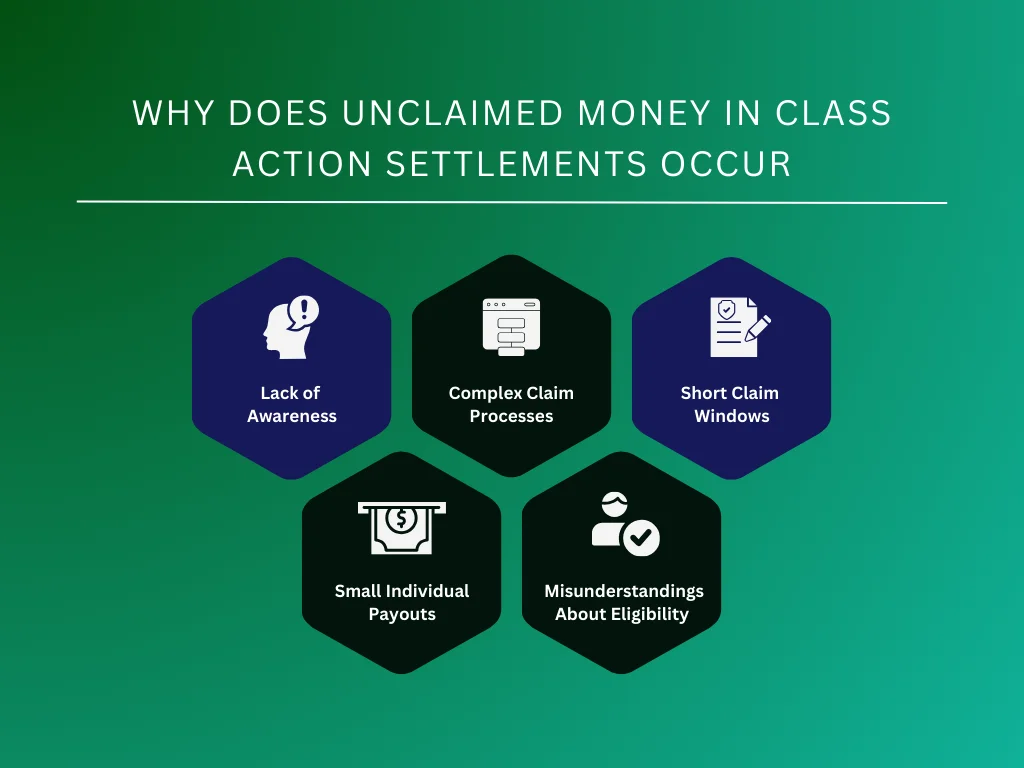

Why Does Unclaimed Money In Class Action Settlements Occur

When discussing unclaimed money class action settlements, we’re addressing funds that have yet to reach their owners. These unclaimed payouts can frustrate claimants and complicate the settlement process. Several factors contribute to this issue, affecting how settlements distribute their funds.

1. Lack of Awareness

Many people need to learn they are eligible for a payout. Settlement notices may only reach some impacted by the issue due to outdated contact information or ineffective communication methods. As a result, potential claimants must be made aware of their rights to claim part of the settlement, leading to unclaimed money.

2. Complex Claim Processes

The procedures to claim settlements can be daunting. Some require extensive paperwork or documentation, which can discourage claimants. People might decide it’s not worth the effort, especially if the expected amount is small. This complexity directly leads to higher amounts of unclaimed money class action settlements.

3. Short Claim Windows

The time frames to submit claims are often relatively short. Busy schedules and delayed mailings can result in missed deadlines. Once the window closes, even eligible individuals can no longer claim their share, adding to the pile of unclaimed money class action settlements.

4. Small Individual Payouts

In some class action settlements, the individual payouts are so small that potential claimants need to see the value in completing the necessary steps to claim their money. This perception reduces the incentive to engage with the settlement process, thereby increasing the volume of unclaimed funds.

5. Misunderstandings About Eligibility

Refraining from deciding who qualifies for the settlement can prevent people from filing claims. Misleading or vague eligibility criteria can deter individuals who qualify from applying due to uncertainty about their status or skepticism about the legitimacy of the process.

What Happens to Unclaimed Class Action Settlement Money?

When a class action lawsuit concludes, the settlement funds should reach everyone entitled to a share. However, not all money always finds its way to the rightful claimants. Here’s what happens to unclaimed money class action settlements:

1. Reversion to the Defendant

Unclaimed money class action settlements often revert to the defendant. This outcome is typically outlined in the settlement agreement itself. If the claimants do not step forward to collect their shares, the money returns to the company or individual that was sued. This process aims to minimize the financial loss for defendants when the damages cannot find their rightful claimants.

2. Escheat to the State

In some instances, if unclaimed settlement funds remain after a certain period, they may escheat to the state. Escheatment laws allow states to take possession of unclaimed property or funds, including money from class action settlements. This method helps ensure that the funds do not remain indefinitely in limbo.

3. Cy Pres Awards

Cy pres awards are another destination for unclaimed money class action settlements. Under this approach, the court can direct the funds to various charities or nonprofits that indirectly benefit the class members or support a cause relevant to the lawsuit. This method aims to fulfill the spirit of the award, even if the direct beneficiaries cannot be compensated.

4. Additional Distributions to Claimants

Sometimes, courts order that unclaimed funds increase the payouts to claimants who have already come forward. This approach distributes the extra funds among existing claimants, enlarging their awards. It specifically rewards those who took the initiative to claim their part and ensures more of the settlement reaches affected individuals.

5. Hold for Future Claims

In cases where it might be anticipated that more claimants will come forward, the settlement administrators may hold the unclaimed money for a future distribution. This method is used when there’s an expectation that the outreach efforts or extended claiming periods might encourage more class members to participate.

How to Claim Your Share In Class Action Settlement

Every year, thousands overlook or miss out on funds due to a lack of information or understanding of the process. Knowing how to claim your rightful share is crucial for settlements of unclaimed money class action.

Here, we outline three steps to claim your unclaimed money class action settlements efficiently:

Step 1: Verify Your Eligibility

Confirming your eligibility is the first step in claiming your share of unclaimed money class action settlements. Check if your name is on the list of class members affected by the specific issue that led to the lawsuit. Most class action websites offer a search tool where you can input your information—like your name, address, or email—to see if you qualify.

Understanding whether you are part of the settlement class is vital. Sometimes, eligibility depends on specific criteria, such as purchasing a product or service during a specific timeframe. Make sure you meet all the required conditions before moving forward. If you have questions, contact the settlement administrator directly. Their contact information is usually listed on their official settlement website.

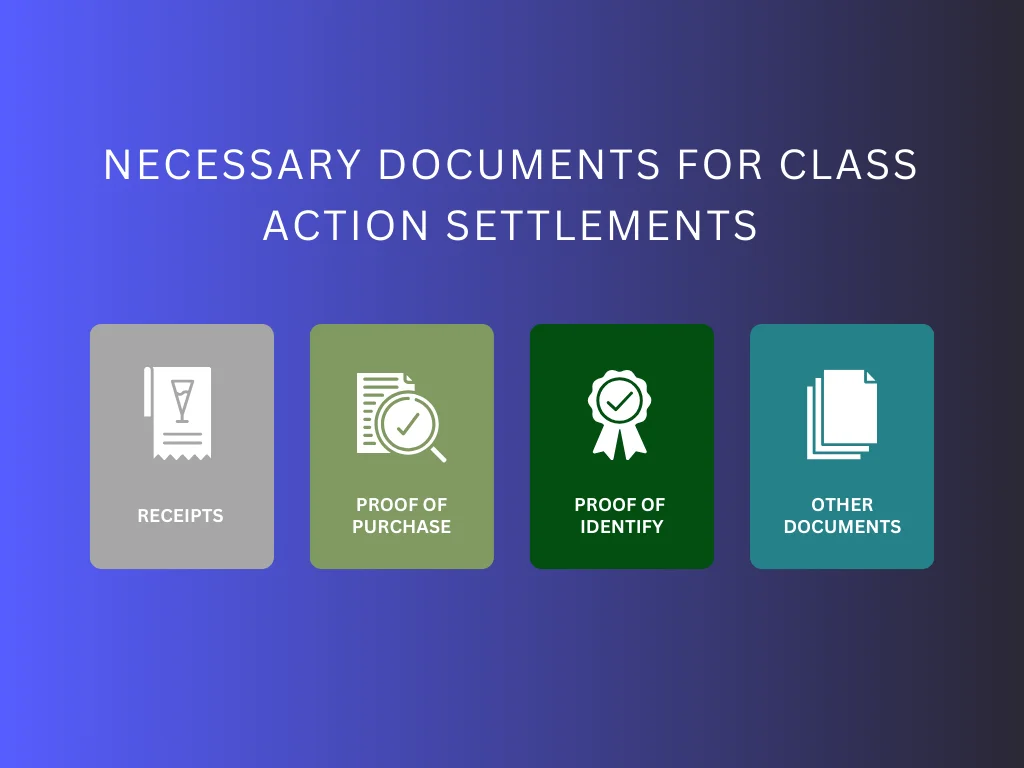

Step 2: Gather Necessary Documents

Once you know you are eligible, gather all necessary documentation. This step is critical as it supports your claim. You might need to provide receipts, proof of purchase, proof of identity, or other documents that verify your involvement in the class covered by the settlement. Keep a copy of all communications and submissions for your records.

Afterward, organize your documents. Label everything and ensure that any digital copies are legible and in an accepted format. Documentation requirements vary widely between different settlements, so check the specific needs outlined on the class action’s official website or settlement notice.

Step 3: Submit Your Claim

Submitting your claim is the final step in the process. Most unclaimed money class action settlements can be claimed via an online form, but some might require mail-in submissions. Be sure to fill out the claim form with accurate information. Double-check your entries for any mistakes that could delay processing.

You may also need to pay close attention to the deadline for submitting claims. Missing this deadline means you forfeit your right to claim any unclaimed money class action settlement. Once submitted, keep track of your claim’s status. Some settlements provide online tools to check your claim’s progress.

Key Takeaway

Managing and claiming unclaimed money class action settlements requires vigilance and prompt action. Keeping track of announcements and updates regarding settlements you might be a part of is crucial. This ensures you don’t miss out on funds rightfully owed you. Staying organized and keeping detailed records can simplify the process when it’s time to claim your share.

To ensure you never leave your money unclaimed, regularly check your eligibility for any current or past class action settlements. Many people need to pay more attention to claiming their portion of unclaimed money class action settlements. Set reminders to review lists of active settlements and submit claims before deadlines. Prompt action is critical to receiving what you deserve without delay.

Are you ready to take control of your financial opportunities in class action settlements? Sparrow is here to streamline the process. Our service saves you time by helping you discover and manage claims effectively. With Sparrow, claiming your share of unclaimed money class action settlements becomes straightforward. Why wait? File a claim to get funds today and take a step towards securing what’s yours.