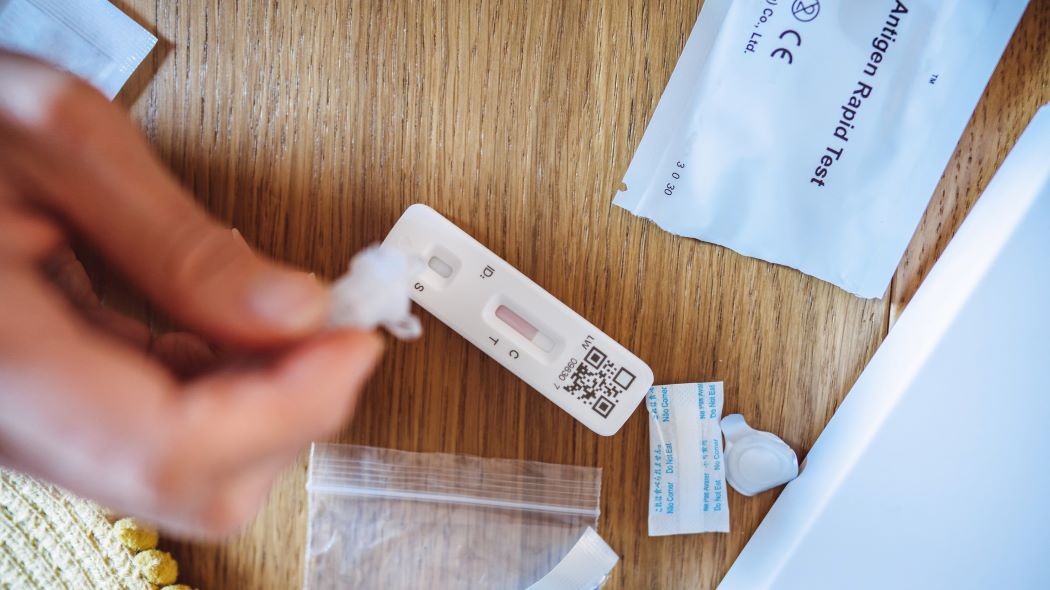

The Cigna COVID-19 test class action settlement has garnered significant attention as policyholders seek compensation for alleged underpayments on COVID-19 tests. This settlement resolves claims that Cigna Health and Life Insurance Co. underpaid for COVID-19 tests submitted under ERISA-governed healthcare plans. Affected individuals may receive a cash award based on the amount they were underpaid, with different procedures depending on whether they received a reimbursement of $500 or less or more than $500.

In this article, we offer a detailed analysis of the case background, outline the step-by-step claim process, and explain who is eligible to benefit from this settlement. Whether you are a current Cigna plan member or a dependent affected by these billing practices, our guide is designed to help you navigate this complex settlement with clarity and confidence.

Detailed Background of the Case

The Cigna COVID-19 test class action settlement arose from allegations that Cigna underpaid for COVID-19 test claims submitted by its policyholders. Specifically, the lawsuit contends that Cigna Health and Life Insurance Co. reimbursed plan members at rates lower than the full amount billed by healthcare providers for COVID-19 tests. The claims focus on individuals who submitted reimbursement requests for tests covered under ERISA-regulated healthcare plans between March 27, 2020, and September 1, 2023.

- Origins and Allegations:

At the onset of the COVID-19 pandemic, many individuals underwent testing expecting their health insurance to cover the full cost. However, when Cigna approved payments at amounts lower than what providers charged, many policyholders were left paying the difference out of pocket. The class action lawsuit alleges that these practices violated the Employee Retirement Income Security Act (ERISA), a federal law that governs employee benefit plans, including health insurance. Policyholders argued that Cigna’s method of processing test claims did not align with the obligations outlined in ERISA, resulting in significant financial burdens during an already challenging period. - Legal Context and Impact:

The legal battle centers on whether Cigna’s billing practices were in accordance with the regulatory requirements intended to protect consumers. By not reimbursing the full amount billed by healthcare providers, the insurer is accused of shifting undue financial responsibility to plan members. The claim asserts that this practice breached the trust that policyholders place in their insurance providers, especially during a public health emergency when access to affordable testing was critical.

As the lawsuit progressed, the mounting public and regulatory pressure led Cigna to settle the dispute. Although the company has not admitted any wrongdoing, it agreed to a nearly $2.91 million settlement to resolve the claims. This settlement not only compensates affected policyholders but also serves as a reminder of the importance of transparent and fair billing practices in the healthcare industry. - Settlement Terms and Changes:

Under the terms of the settlement, affected class members can receive a cash payment based on the amount they were underpaid. The process distinguishes between two groups: those who received a reimbursement of $500 or less, who will automatically receive a proportional share of the settlement fund, and those who received more than $500, who must file a claim with supporting documentation to verify the underpayment.

In addition to the financial remedy, the settlement aims to prompt changes in how insurers handle reimbursement claims to prevent similar issues in the future. This case highlights the broader need for accountability in healthcare billing practices, especially during crisis periods when consumer protection is paramount.

- Broader Implications:

The Cigna COVID-19 test class action settlement is significant because it addresses systemic issues in health insurance billing during the pandemic. It underscores the responsibility of insurers to adhere to federal regulations and protect consumers from unfair financial practices. The case has sparked discussions among consumer rights advocates, legal experts, and regulators about the need for more robust oversight of billing practices. Ultimately, the settlement reflects a proactive approach to resolving disputes and restoring confidence in the healthcare system during turbulent times.

How to File a Claim

If you believe you qualify for the Cigna COVID-19 test class action settlement, here are the steps you need to take:

- Visit the Official Settlement Website:

- Navigate to the official settlement site (linked on the settlement notice) to review instructions and download the necessary claim forms.

- The website provides detailed guidelines on what documents are required and how to complete the process.

- Alternative Option with Sparrow:

- For a simplified, user-friendly experience, consider using Sparrow to help you with the claim process.

- Our platform offers step-by-step guidance, ensuring that your claim is accurate and submitted efficiently.

- Gather Your Documentation:

- Collect your billing statements, receipts, or any record showing the amount you were charged for the COVID-19 test.

- For claims involving tests where you paid more than $500, ensure you have proof of payment from your bank, credit card, or other payment platforms.

- Determine Your Claim Category:

- For Reimbursements of $500 or Less:

- No additional claim form is required; you will automatically receive your proportional share from the settlement fund.

- For Reimbursements of More Than $500:

- Complete the claim form and attach supporting documentation that verifies the full amount billed by your provider and the amount reimbursed by Cigna.

- For Reimbursements of $500 or Less:

- Submit Your Claim:

- If filing through the official website, follow the instructions to upload your claim form and documents.

- If you choose to use usesparrow.com, our service will help verify your information and ensure your submission meets all requirements.

How Much You Can Receive from the Settlement

Understanding your potential award under the Cigna COVID-19 test class action settlement is essential:

- Estimated Award Amount:

- The settlement fund totals nearly $2.91 million.

- Eligible claimants may receive up to $500 or more, depending on the amount by which they were underpaid.

- Determining Your Compensation:

- If you received reimbursement of $500 or less, your share of the settlement will be calculated proportionally based on the underpaid amount.

- For those who received more than $500, you will need to submit a claim with supporting documents. The final payment will reflect the difference between what you were billed and what was reimbursed by Cigna.

- No Out-of-Pocket Costs:

- Filing your claim is free.

- Both the official process and services like usesparrow.com are designed to help you submit your claim without incurring additional fees.

- Distribution Process:

- Once the final approval hearing is completed and all claims are processed, payments will be distributed to eligible claimants.

Who is Eligible to File a Claim

Eligibility for the Cigna COVID-19 test class action settlement is determined by specific criteria:

- Affected Policyholders and Dependents:

- The settlement benefits individuals who submitted a claim to Cigna for reimbursement from an ERISA-governed healthcare plan.

- The claim must relate to a COVID-19 test obtained between March 27, 2020, and September 1, 2023.

- Underpayment for COVID-19 Tests:

- You must have experienced underpayment, where Cigna approved payment at less than the full amount billed by the healthcare provider.

- The claim applies to both plan members and their dependents affected by these billing practices.

- Documentation Requirements:

- For claims involving tests with reimbursements over $500, you must provide supporting documentation. This includes receipts, billing statements, and records from payment methods such as bank or credit card statements.

- The documentation must clearly show the service provider, the service date, the amount billed, and the actual payment made.

- Automatic Inclusion:

- If you received a reimbursement of $500 or less, you will automatically be included in the settlement unless you formally exclude yourself.

- Those who do not wish to participate must follow the exclusion instructions provided on the official settlement website.

Important Deadlines

Acting promptly is crucial for the Cigna COVID-19 test class action settlement. Be sure to note the following key dates:

- Exclusion and Objection Deadline:

- All class members who do not wish to participate must formally exclude themselves by April 29, 2025.

- Ensure you follow the instructions on the official settlement website to register your exclusion or objection.

- Claim Submission Deadline:

- For claimants who received reimbursement of more than $500, the valid claim form and all supporting documentation must be submitted by April 29, 2025.

- Final Approval Hearing:

- The final approval hearing for the settlement is scheduled for May 29, 2025.

- This hearing will determine the final distribution of the settlement funds, so staying updated on any announcements is critical.

- Ongoing Notifications:

- After you submit your claim, keep an eye on updates via the official settlement website or through notifications from Sparrow.

- These communications will provide additional instructions or updates regarding the payment process.

Conclusion

The Cigna COVID-19 test class action settlement represents a significant opportunity for affected policyholders and dependents to recover funds for underpayments related to COVID-19 tests. Through this detailed guide, we have explored the background of the case, which centers on allegations that Cigna underpaid for tests by reimbursing less than the full billed amount. We have outlined a clear, step-by-step process for filing your claim—whether through the official website or with the assistance of Sparrow—and discussed the potential financial benefits, eligibility criteria, and crucial deadlines. Understanding the nuances of this settlement, you can confidently determine your eligibility and take the necessary steps to secure the compensation you deserve. Acting promptly and staying informed are essential to navigating this process effectively and ensuring that your claim is processed without issue.