Bob McNeil initiated a class action lawsuit against Capital One Bank NA in September 2020, alleging improper assessment of overdraft and non-sufficient funds (NSF) fees. The plaintiff claimed that Capital One breached its contractual obligations and violated consumer protection laws by charging multiple fees for reprocessed transactions. This lawsuit eventually reached an agreement that could grant each class member a Capital One settlement claim.

At Sparrow, we have extensive experience in helping class members receive compensation from various class action settlements, from digital service disputes like the recent Amazon class action lawsuit to retail and real estate. Our experienced team provides the tools and support to easily submit claims, track status, and receive updates on settlements, ensuring class members understand their rights and navigate the legal process effectively.

Capitalizing on our industry know-how, we’ve put together this blog to give you all the important details on the Capital One class action settlement. Read on to find out if you’re eligible to join this lawsuit, file claims, and navigate the process with ease. We’ll also discuss the allegations, the company’s stance, and settlement details so you can stay informed on what you can expect moving forward.

Let’s get started!

Capital One Company Background

Capital One is a popular bank and money lender that offers a variety of financial products, such as checking accounts, savings accounts, and loans. It is one of the biggest commercial banks in the financial services industry, currently serving over 100 million customers with more than 750 branches across the United States. Capital One is also known for its credit card offerings, such as free credit reports, reward programs, credit monitoring, and credit score assistance.

Despite its fairly favorable reputation, there have been a few Capital One settlement claims paid out over the years. A recent major class action targeted its handling of customer data, where a data breach exposed the personal information of millions of customers. This incident raised significant concerns about the bank’s data security measures. Similarly, the current class action centers around Capital One’s representment fees, highlighting ongoing issues with how the bank manages customer accounts and charges.

Case Details: Capital One Settlement Claim

The Capital One class action lawsuit alleges that the company didn’t refund fees accurately. These include NSF and overdraft fees for checks or electronic payments that were returned for insufficient funds. After charging a fee once, Capital One should have refunded the fees charged for the same payment.

Allegations

The allegations are based on Capital One’s allegedly wrongful charging of representment fees to both current and former account holders. Representment is the process through which merchants dispute chargebacks to payment card issuers by providing evidence that the transaction was valid and should not be reversed. Here is a breakdown of the allegations:

- Breach of Contract: According to the plaintiff, Capital One breached its Account Agreements by charging multiple non-sufficient funds (NSF) fees for reprocessed transactions.

- Misleading Definitions: The plaintiff contends that Capital One’s definition of “item” in the Agreements is misleading because it allowed the bank to charge multiple NSF fees for a single transaction that was reprocessed multiple times. Industry usage dictates that an “item” should not be considered a new “item” each time it is reprocessed.

- Unjust Enrichment: The plaintiff argues that Capital One was unjustly enriched by charging these multiple fees, although it was dismissed by the court because it was deemed duplicative of the breach of contract claim.

- Violation of State Law: With its misuse of terms, Capital One allegedly violated the New York General Business Law § 349, which protects consumers from deceptive business acts.

These allegations highlight the complex interactions between contractual terms, consumer protection laws, and ethical business practices. The breach of contract allegation can be the most damaging, as it directly challenges the legitimacy of Capital One’s fee practices.

If proven true, the company may be obligated to pay much more than $16 million should a future class action make that allegation again.

Company’s Stance on the Case

Capital One counters the plaintiff’s claims on grounds of preemption under the National Bank Act and OCC regulations. The company asserts that these federal laws override the state laws that the plaintiff invokes. They maintain that it is their right to charge fees as protected and authorized by federal law.

Additionally, Capital One states that it fully adhered to the terms of its Account Agreements and did not breach any contractual terms. Thus, they argue that the plaintiff’s claims for breach of contract are unfounded because the fees were charged according to the agreed-upon terms.

Settlement Details

Although Capital One is mounting a defense against the allegations, it agreed to a settlement totaling $16 million. After deducting legal fees and other costs, the net amount available for Capital One settlement claims is $10,308,909.16.

Class members can receive a pro-rata (proportional) share of the net settlement fund based on the number of eligible fees they were charged between September 1, 2015, and January 12, 2022. Those who currently hold an account with Capital One will be credited their share of the settlement fund in their account, while former account holders will receive a check.

Eligibility to Claim

If you were an account holder with Capital One from September 1, 2015, to January 12, 2022, and were charged representment fees during this period, you are eligible for a payment from the settlement fund. The $10 million net settlement fund will be divided by each Capital One settlement claim. The amount each claimant gets may be adjusted before the final approval hearing depending on how many class members there are.

Timeline of Action

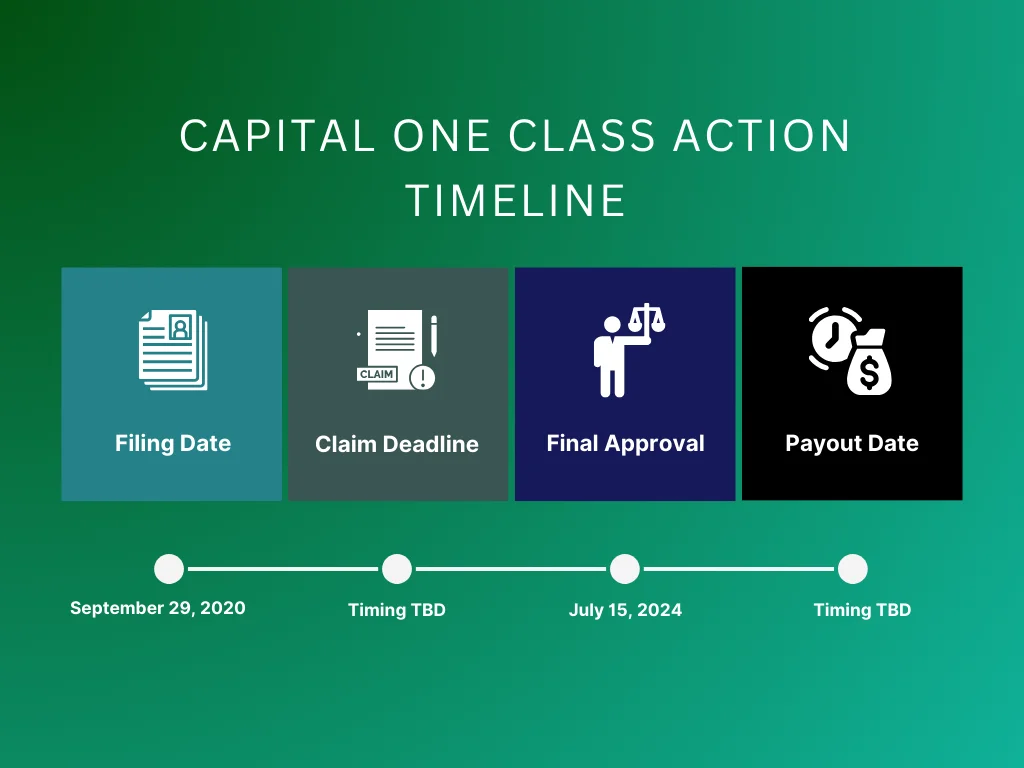

Since class members do not need to submit a Capital One settlement claim form to get their compensation, there’s less need to follow the timeline of the case. However, it still pays to stay updated on the outcome of important dates.

Here is how the timeline of action for the case has transpired so far:

- Filing Date: The Capital One class action lawsuit titled McNeil v. Capital One Bank NA was filed on September 29, 2020, in the U.S. District Court for the Eastern District of New York.

- Claim Filing Deadline: Since class members do not need to file a form to be compensated for their Capital One settlement claim, there is no actual claim filing deadline.

- Final Approval: The final hearing is scheduled for July 15, 2024, to be presided over by Frederic Block, Senior District Judge for Brooklyn, New York.

- Payout Date: At the time of this writing, the payout date for the Capital One settlement claims has yet to be decided. It is likely to be announced sometime after the final approval hearing has concluded.

While class members are not required to file individual claims to receive compensation from their Capital One settlement claim, the specific timeline for payouts remains pending until after the court’s final decision. Stay tuned for further updates on the distribution of settlement benefits and other developments in the case.

How to File a Claim

Capital One will automatically compensate all class members, eliminating unclaimed funds from the settlement. Class members do not need to present evidence, provide account information, or submit a Capital One settlement claim form to receive their share of the settlement fund. Claimants are scheduled to receive a payment by the payout date decided in the final approval hearing on July 15, 2024.

Key Takeaway

Although Capital One provides a reasonable defense against the plaintiff’s allegations, its actions still constitute unethical business practices. The fact remains that there was a discrepancy between consumer expectations and how the bank’s fee policies were put into practice. The $16 million to be divided among each Capital One settlement claim underscores their internal operations to be fairer and more transparent in fee structures.

If you’re an eligible claimant, you will automatically receive compensation for your Capital One settlement claim without needing to take action. The company will automatically remit compensation to current account holders and provide checks to those who have already closed their accounts. Although there are no deadlines to miss, and all eligible class members will automatically receive compensation, it still pays to follow the case timeline for essential updates.

Are you or anyone you know eligible for a class action similar to this one? Don’t hesitate to contact Sparrow if you’re lost on how to join a class action lawsuit. We help affected individuals discover class actions they are eligible for and ensure a smooth and hassle-free joining process with prompt compensation from the settlement.