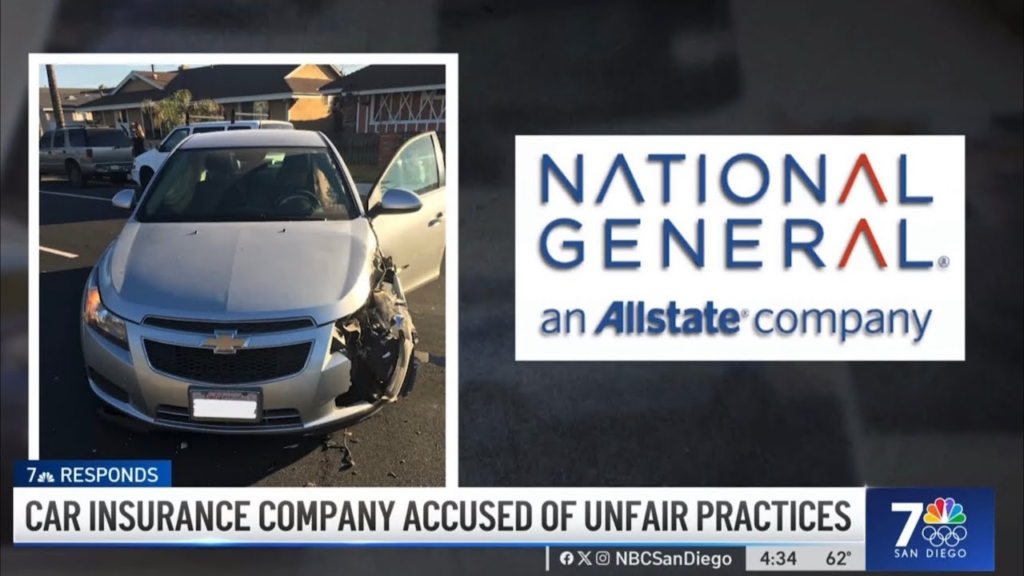

Navigating insurance claims can be challenging, especially when policyholders suspect they’re not getting fair treatment. In California, numerous consumers are now voicing concerns over National General Insurance—one of the country’s leading providers of auto, home, and other coverage options. These complaints have sparked a California National General Insurance class action lawsuit investigation, with policyholders alleging they’ve been subjected to unfair claims practices, possible underpayments, or other unjust tactics.

If you have or had a National General Insurance policy in California, it’s crucial to stay informed about the investigation’s progress, potential legal remedies, and your rights as a consumer. Below, we delve into the specifics of the case, common allegations, and what you can do if you think you’ve been affected.

Understanding the California National General Insurance Lawsuit

Background on National General Insurance

National General Insurance (NGI) is a major provider of personal and commercial coverage in multiple states, including California. It offers various policies—ranging from auto and homeowners insurance to RV and motorcycle coverage. Over time, however, some California policyholders have raised red flags about the company’s practices. They claim that National General’s handling of claims, premiums, or policy terms may not always align with consumer protection laws.

What Sparked the Investigation?

Consumer complaints often serve as the catalyst for large-scale investigations. According to recent updates on Top Class Actions, allegations against National General Insurance involve:

- Underpayment or delayed payment of valid claims

- Improper denial of coverage

- Misrepresentation of policy terms and exclusions

- Potentially excessive premiums relative to coverage scope

With these recurring themes, legal professionals and consumer advocates launched a class action lawsuit investigation in California to determine if NGI’s practices could violate local or federal regulations protecting insured individuals.

Key Allegations in the National General Insurance Class Action

1. Unfair Claims Settlement

A primary concern among policyholders is whether National General Insurance employs unfair tactics to limit the amount paid out on legitimate claims. This can include:

- Delaying Payments: Taking an unusually long time to process claims, effectively leaving insured parties in difficult financial situations.

- Undervaluing Damages: Offering settlement amounts that are allegedly lower than repair or replacement costs for covered incidents.

- Frequent Denials: Some policyholders say they’ve experienced seemingly arbitrary denials without sufficient explanation or a thorough investigation.

2. Misleading Policy Terms

Insurers must provide clear and transparent policy documents. However, plaintiffs in the California National General Insurance class action allege that NGI’s contracts may be ambiguous, making it difficult for policyholders to understand their actual coverage limits. According to these complaints:

- Exclusions might not be highlighted, leaving consumers unaware of what’s not covered until they file a claim.

- Premium Increases or policy adjustments may not be communicated clearly, causing confusion about rising costs.

3. Overcharging or Inflated Premiums

Some policyholders report increases in premiums that outpace any changes in coverage or risk factors. The investigation aims to uncover whether these rate hikes were justified and whether NGI adequately explained them to consumers.

Determining Eligibility and Next Steps for Policyholders

- Review Your Policy Documents

Check the fine print of your National General Insurance policies—whether it’s for auto, home, or another type of coverage. Make a note of coverage limits, deductibles, and any clauses that could lead to claim denials. - Examine Your Claims History

If you’ve ever filed a claim with NGI and received less than expected or were denied coverage entirely, gather all related documents. These include adjuster reports, claim forms, repair estimates, and email communications. - Track Unusual Premium Hikes

Sudden or unexplained premium increases may be relevant to the ongoing investigation. Keep a record of all billing notices and compare them with any changes in your coverage or risk profile (e.g., a new car, home renovations). - Stay Updated on Lawsuit Developments

Monitor reputable legal news outlets or consumer advocacy platforms such as Top Class Actions. Updates may include:- Filing Deadlines: If a class action is formally certified, you’ll need to know any cut-off dates for joining the lawsuit.

- Settlement Announcements: Proposed settlements could provide financial relief or require National General Insurance to modify its policies and practices.

- Consult Legal Advice if Necessary

If you believe you’ve been directly affected, consult with a qualified attorney experienced in insurance class actions. They can clarify your rights and help you decide whether joining a potential class action or pursuing individual legal action is appropriate.

Possible Outcomes of the National General Insurance Lawsuit

- Settlement or Judgment: If the court or a settlement process finds that NGI engaged in unfair practices, the company may be required to compensate policyholders or change its claim-handling procedures.

- Policy Revisions: National General Insurance could be mandated to revise its underwriting guidelines, claims-handling process, or billing transparency.

- Increased Regulatory Oversight: State or federal agencies might step in to ensure the company complies with consumer protection laws moving forward.

Conclusion

The California National General Insurance class action lawsuit investigation underscores the critical role transparency and fairness play in the insurance industry. Policyholders who suspect they’ve been shortchanged on claims or burdened with unjust premiums have a right to seek clarity and, if necessary, legal redress. By staying informed, gathering documentation, and seeking expert advice, you can better understand how this investigation may affect you—and what steps to take if you believe you’re owed compensation.

As the legal process unfolds, updates may clarify whether National General Insurance indeed violated California’s consumer protection rules. In the meantime, proactive measures like reviewing policy details and consulting legal counsel are the best ways to protect yourself from potential billing or coverage pitfalls.