Market America, a prominent multilevel marketing (MLM) company, has been involved in a legal dispute since 2017, when the Market America lawsuit was first filed, accusing the company of deceptive business practices. Plaintiffs argue it operates as a pyramid scheme, where distributors make money by recruiting others rather than selling products. Many distributors claim they were misled into making significant financial investments in inventory, seminars, and fees—only to lose money.

At Sparrow, we specialize in supporting individuals caught in legal battles involving deceptive business practices, such as the Macy’s class action lawsuit. Our expertise in handling complex class actions ensures that you can confidently navigate cases like the Market America lawsuit and seek rightful compensation.

Drawing on our expertise in handling class-action lawsuits and multi-party disputes, we’ve developed this comprehensive overview of the Market America lawsuit. We’ll break down the key allegations, provide a timeline of legal proceedings, and explore how this lawsuit affects distributors and consumers alike.

Let’s dive in!

Overview of the Market America Lawsuit

What is Market America, and how did it find itself involved in a federal lawsuit?

Market America MLM, a multi-level marketing company founded in 1992 by James Howard Ridinger and Loren Ridinger, is headquartered in Greensboro, NC, United States. The company offers a wide range of products, including dietary supplements, personal care products, cosmetics, home goods, and auto care products.

Market America works through a network of independent distributors called “UnFranchise Owners” who sell these products while recruiting new members, a core aspect of its business model.

Allegations Against Market America

Is Market America a pyramid scheme? In the 2017 Market America lawsuit, former distributors Chaunjie Yang and Ollie Lan filed a class action lawsuit alleging that the company operated a pyramid scheme designed to benefit participants at the top, leaving most with minimal earnings.

The lawsuit asserted that Market America persuaded distributors to invest large sums upfront—such as a 399 dollars start-up fee, monthly payments for product purchases, and event attendance costs—while promising significant earnings that never materialized.

The lawsuit described Market America as an illegal pyramid scheme and highlighted its claim that “the only way to fail under Market America’s business model is to quit.” The plaintiffs also alleged that the company targeted Chinese-American immigrants to sell products to friends and relatives in Asia.

Furthermore, plaintiffs alleged that Market America engaged in illegal racketeering practices, including:

- Misleading Income Promises: The company advertised that distributors could earn six-figure incomes, yet in reality, the vast majority of participants saw little to no earnings.

- Predatory Advertising: The company violated FTC law when it made hundreds of atypical earnings claims through its website and social media pages such as Facebook, Twitter, and Instagram.

- Exorbitant Costs: Distributors were required to continually invest in products, events, and training, making it nearly impossible to recover their initial investments.

- Violation of the RICO Act: The lawsuit also accused Market America of violating the Racketeer Influenced and Corrupt Organizations (RICO) Act by structuring its operations in a way that unfairly profited from new recruits.

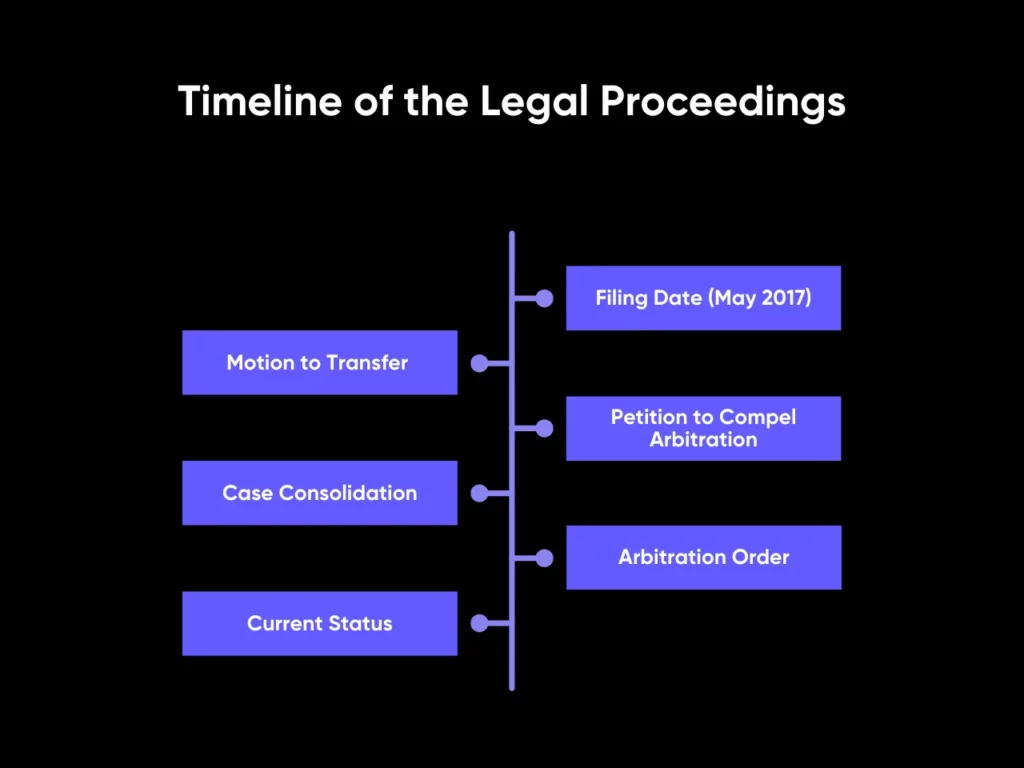

Timeline of the Legal Proceedings

The Market America class-action lawsuit has followed a complex timeline involving multiple procedural developments and shifts in jurisdiction. As the case progresses through arbitration, some details and future dates are yet to be finalized. Here’s how the timeline of this lawsuit has unfolded so far:

- Filing Date: In May 2017, former distributors Chaunjie Yang and Ollie Lan initiated a class-action lawsuit against Market America under California state law, claiming that the company’s $7.3 billion valuation was inflated through racketeering and deceptive recruitment practices under a “two-year blueprint” that promised high earnings.

- Motion to Transfer: In August 2017, Market America filed a motion to compel arbitration based on agreements signed by the plaintiffs when they became distributors. Alternatively, they moved to transfer the case to North Carolina, where the company is headquartered.

- Petition to Compel Arbitration: In October 2017, Market America filed a petition to compel arbitration in the Middle District of North Carolina, as the arbitration agreements specified that arbitration should occur in Greensboro, North Carolina.

- Order Compelling Arbitration: On April 10, 2019, the Middle District of North Carolina court formally issued an order compelling arbitration and stayed the case, directing the parties to proceed with arbitration.

- Transfer of California Case to North Carolina: On May 13, 2019, the Central District of California court officially transferred the case to the Middle District of North Carolina.

- Filing of Second Related Case: In March 2019, additional plaintiffs, including Jinhua Zou and Yu Xia Lu, along with Yang, Lan, and Liu Liu, filed a new class-action lawsuit against Market America in the Northern District of California, alleging similar claims of operating an illegal pyramid scheme.

- Transfer of Second Case to North Carolina: On September 12, 2019, the Northern District of California court transferred the case to the Middle District of North Carolina, applying the first-to-file rule due to substantial similarity with the earlier case.

- Case Consolidation and Arbitration Order: In January 2020, the Middle District of North Carolina court consolidated the cases and formally stayed the proceedings, directing all claims to proceed through arbitration, significantly slowing down court litigation.

- Current Status: The lawsuit has been merged with related cases, broadening the scope of claims against Market America for alleged deceptive practices under the RICO Act. This includes accusations of fraudulent marketing and financial misrepresentation, which are now under review in arbitration.

Despite the legal delays, the case remains active in arbitration, with no clear resolution in sight. Depending on the outcome of these proceedings, further developments could involve either settlements or continued legal challenges.

Impact on Distributors and Consumers

The Market America lawsuit has placed a significant financial burden on many of the company’s distributors. The core allegation is that these distributors were encouraged to invest heavily in the business, spending between $130 to $300 per month on products, plus additional costs for seminars and events that were marketed as essential for success.

Distributors were often led to believe that they could achieve substantial earnings by following the company’s model. However, the reality for many has been starkly different, with reports indicating that over 90% of participants failed to earn a profit.

Consumers have also been affected. Some have raised concerns over the safety of Market America’s products, with allegations of health issues linked to certain supplements. In 2020, the company received a warning from the FDA regarding misleading health claims related to its products, which further tarnished its reputation.

Legal Basis and Ongoing Court Actions

The legal challenges facing Market America center on accusations of running a pyramid scheme scam. Despite the company’s insistence that it operates a product-based business model, regulatory scrutiny and investigations have led to legal battles.

Pyramid Scheme Allegations

At the core of the lawsuit is the allegation that Market America operates as a pyramid scheme, which focuses more on recruiting new members rather than selling products. This is illegal and tends to benefit only those at the top, leaving the majority with little or no income.

Market America denies these allegations, asserting that it operates a legitimate multi-level marketing business. The company argues that its business model is product-driven and that income is earned through product sales rather than recruitment. Market America’s executives have repeatedly defended the company’s practices, insisting that success is achievable through hard work and proper business strategy.

Regulatory Scrutiny and Investigations

The arbitration proceedings have kept the details of any oversight protocols resorted to under wraps. However, Market America will likely be meted out with the same penalties as they have incurred for their previous legal violations.

Market America has faced regulatory challenges throughout its history, notably involving multiple U.S. agencies. In 1999, the Securities and Exchange Commission (SEC) filed a civil enforcement action against Market America’s CEO, James Ridinger, and former stockbroker Gilbert Zwetsch. The SEC accused the pair of engaging in fraudulent activities related to unregistered sales of Market America stock.

Market America also faced warnings from the Federal Trade Commission (FTC) during the COVID-19 pandemic in 2020. The company was flagged for misleading earnings claims, especially suggesting that joining their UnFranchise system could replace lost income due to the pandemic. The FTC emphasized that such deceptive earnings claims violated the law.

In the same year, 2020, the consumer watchdog group Truth In Advertising launched an investigation into Market America. They found over 450 deceptive income claims made by the company on various platforms within the first nine months of the year. As a result of the scrutiny, Market America was forced to remove approximately 750 misleading marketing claims from its materials.

Defense Strategy from Market America

Market America’s defense strategy in its lawsuit has been focused on proving the legitimacy of its multi-level marketing model. Market America claimed that their shopping annuity and cashback program schemes provided an economic solution for individuals who desire financial freedom. Market America emphasizes that it provides distributors with clear disclosures about the risks involved and that any financial losses incurred are due to individual business decisions, not systemic flaws within the company’s structure.

Market America responded to regulatory demands by removing hundreds of exaggerated income claims from its marketing materials after a warning from a consumer watchdog group. This move was likely part of a broader legal and PR strategy to maintain transparency and mitigate the negative impact of the lawsuit on its reputation and operational integrity.

Additionally, Market America’s defense portrays the lawsuit as being driven by disgruntled former distributors. They argue that the plaintiffs, who allege deceptive business practices, have misunderstood the MLM model or are presenting a skewed version of their involvement.

Key Developments in the Case

Recent Court Rulings

In January 2020, a significant development occurred in the Market America lawsuit when a magistrate judge granted Market America’s motion to compel arbitration. This order effectively moved the case from the public courts to a private arbitration setting. The court also consolidated the case with Market America v. Yang (Case No. 17-cv-897). With the case now in arbitration, any outcomes and subsequent rulings remain confidential, keeping the resolution out of public record.

Class-Action Status and Participation

Arbitration in the Market America lawsuit has shifted the legal process from the public eye into private proceedings. When the company successfully moved the case to arbitration in January 2020, it took the dispute out of open court, keeping the details and potential outcomes confidential.

For participants, this change is significant. Market America’s arbitration agreement likely includes a clause preventing class actions, requiring individuals to resolve disputes individually. By moving the case to arbitration, the company has avoided facing a collective lawsuit, lowering the risk of larger financial liabilities.

If you didn’t join the class action before arbitration was enforced, you might be blocked from joining later legal proceedings under that lawsuit. Arbitration, being binding, typically bars participants from re-entering court after the process begins.

Potential Settlements or Resolutions

The case’s transfer to arbitration suggests that a public trial is unlikely, as arbitration is intended to be the final resolution mechanism. Whether the case ends in a settlement or a binding decision from the arbitrator, it is clear that the dispute will not be revisited in a public court unless an exceptional appeal occurs.

The arbitration process keeps the possibility of a confidential settlement open, but any resolution or movement toward settlement will likely remain out of the public eye unless disclosed voluntarily by either party.

Key Takeaway

The Market America lawsuit highlights how arbitration agreements create significant hurdles for participants seeking justice. These clauses block class-action lawsuits and strip distributors of their opportunity to have a jury trial or appeal a decision, further tilting the scales in favor of the company. Participants often face delays and hidden costs in arbitration, making the process even more complex to navigate.

The case also exposes deeper issues within MLMs, like aggressive recruitment tactics that disproportionately target vulnerable communities. Many participants were lured in with promises of success, only to be left in financial distress when the system rewarded recruitment over sales.

Understanding the broader implications of these legal tools and deceptive business practices is critical for those looking to hold MLMs accountable. Sparrow can help you assess your legal options if you’re navigating a similar situation. We provide resources for other ongoing class action lawsuits where you might be eligible for compensation. Explore the Sparrow blog for more information, or contact our team at contact@usesparrow.com for personalized updates and support.