Unpaid wages remain a prevalent issue in workplaces across the United States. Recent data reveals an alarming trend of wage violations, including missed overtime pay and failure to meet minimum wage requirements. In fiscal year 2023, the Department of Labor’s Wage and Hour Division recovered the average settlement for unpaid wages of over $274 million for more than 163,000 employees, highlighting this issue’s severity and widespread nature.

At Sparrow, we support workers in recovering unpaid wages, including minimum wage discrepancies and overtime pay violations. Our platform leverages deep insights from numerous cases and a comprehensive understanding of federal, state, and hour laws to offer a streamlined solution for managing class action lawsuits and wage claim submissions. Our approach simplifies the process and enhances the effectiveness of legal action against wage theft.

Informed by our experience and driven by a commitment to workers’ rights, we’ve put together this comprehensive guide on the average settlement for unpaid wages. We will explore the latest insights on average settlement amounts for unpaid wages, covering eligible claim types, prevailing trends, and actionable steps for effective pursuit.

Let’s get started!

What Is Average Settlement for Unpaid Wages?

The average settlement for unpaid wages refers to the amount of money employees recover when employers fail to pay them according to the law. This settlement varies widely based on the specifics of each case, including the duration of unpaid wages and the number of employees affected.

Types of Unpaid Wages Eligible for Settlement Claims

Several types of unpaid wages can qualify for claims under wage laws, including:

- Overtime Hours: Not being compensated at the required overtime rate can significantly lead to significant settlements if the unpaid overtime extends over a long period.

- Rest Breaks: Under the law and other state regulations, employees not allowed to take their lawful breaks may seek compensation.

- Minimum Wage Violations: Cases where workers earn less than the local or federal minimum wage often result in settlements to cover the difference up to the lowest minimum wage.

- Hour Violations: Include not compensating for all hours worked regularly, often leading to claims processed through the labor commissioner’s office.

Each type of claim can impact the average settlement for unpaid wages, with factors like the statute of limitations, court costs, and attorney’s fees playing critical roles. Experienced employment law attorneys often advise clients on their legal options, ensuring they pursue fair compensation for the stress of unpaid wages.

3+ Trends in the Average Settlement for Unpaid Wages in the United States

The average settlement for unpaid wages has seen several trends influenced by evolving federal and state laws. Workers across the United States increasingly pursue legal claims to recover unpaid wages, with employment lawyers noting significant activity in this area. Here are the top three trends:

1. Rise in Class Action Lawsuits

There has been a notable increase in class action lawsuits involving large companies accused of failing to pay hourly wages or not adhering to local minimum wage requirements. These cases often result in substantial settlements for unpaid wages, including back wages and punitive damages, which aim to deter employers from future violations.

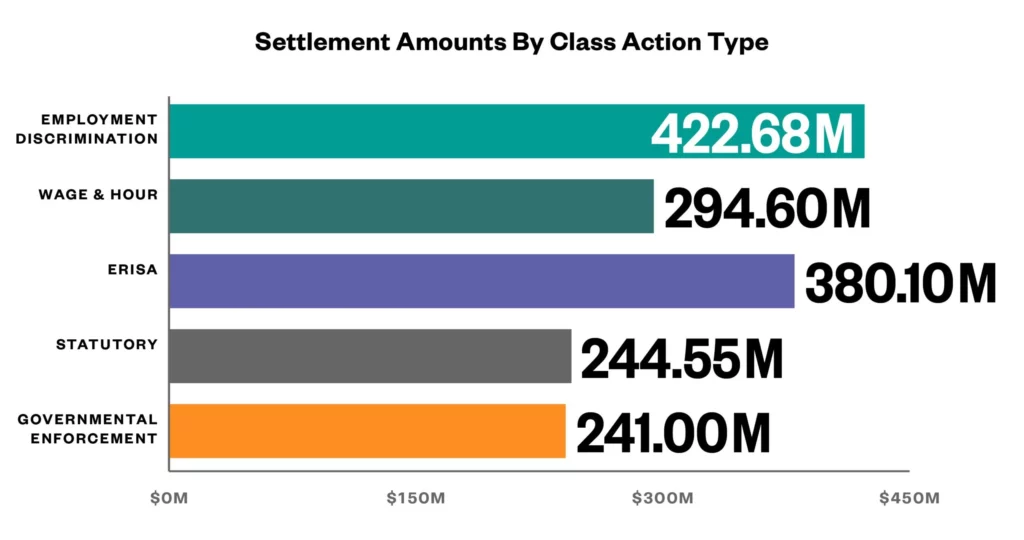

In this breakdown, “Wage & Hour” class actions directly address issues such as unpaid wages, overtime, and minimum wage violations, which have amassed settlements totaling $294.60 million. This substantial figure underscores the significant financial impact and the prevalence of wage-related disputes in the labor market.

2. Technological Impact on Wage Statements and Claims

Technology has revolutionized how wage statements are managed and hour claims are processed. Employees now have tools to track their regular pay rate and compare it against their employment contract and offer letter. This shift has led to more employees in good faith pursuing unpaid wage claims when discrepancies are noticed. The average settlement for unpaid wages benefits from this transparency, ensuring workers are compensated fairly.

3. Increased Awareness and Enforcement of Labor Laws

Awareness about labor rights has grown, especially with the introduction of digital platforms that simplify access to specific information about unpaid wage claims. The enforcement of the Fair Labor Standards Act and state laws and regulations have played crucial roles in ensuring employees receive at least minimum wage and overtime wages. As a result, the average settlement for unpaid wages has increased, reflecting a more vital adherence to fair pay principles.

4. Shift Towards Higher Settlements Due to Public and Legal Pressure

Employers face growing public and legal pressure to comply with fair labor practices, including paying at least minimum wage and honoring the regular pay rate promised in good faith. This pressure and more robust labor laws have led to a noticeable increase in the average settlement for unpaid wages. Employers aiming to avoid punitive damages and protect their reputation are more likely to settle unpaid wage claims quickly and fairly.

How To Determine the Worth of Unpaid Wage Settlements

Knowing how much to expect from a settlement can guide your decisions and preparations when dealing with unpaid wages. The average settlement for unpaid wages varies greatly, but several key factors influence the amount you might receive. Here are five crucial aspects to consider:

1. Assess Total Hours Worked Unpaid

The first step in calculating the average settlement for unpaid wages is to determine how many hours you were not paid for accurately. This includes overtime, missed breaks, or hours worked off the clock. Keep detailed records or timesheets if possible, as these will serve as the foundation for your claim—the more precise your records, the more transparent the calculation of your owed wages.

2. Evaluate Wage Rate

Consider the wage rate applicable during the hours you worked. This includes your regular hourly rate and, if applicable, an overtime rate. In many cases, unpaid wages involve the absence of regular pay and the higher rates due for overtime, typically time and a half. Calculating this will give a more accurate estimate of the average settlement for unpaid wages.

3. Factor in Statutory Penalties

Many jurisdictions impose penalties on employers who fail to pay wages. These penalties vary widely but can significantly increase the value of a wage claim. For instance, some states require employers to pay an additional sum as a penalty, calculated daily until the full unpaid wage is settled. Understanding these penalties is crucial to determining the potential total of an average settlement for unpaid wages.

4. Account for Legal Precedents

Look at previous cases with similar circumstances to gauge the average settlement for unpaid wages. Legal precedents can provide a ballpark figure and inform you about the outcomes of cases similar to yours. Consulting with legal professionals who can access detailed case databases will offer insight into what you might expect from your claim.

5. Consider Settlement Duration

The duration over which the unpaid wages accrued plays a significant role in calculating the settlement. A prolonged period of unpaid wages can lead to a higher settlement due to accumulating unpaid hours. It is essential to trace back to when the first payment was missed to understand the full scope of the claim.

How To Pursue an Unpaid Wage Claim

Understanding the process of pursuing an unpaid wage claim is important for recovering your rightful earnings. Here are the three steps to help you assert your rights and navigate the complexities of claiming the average settlement for unpaid wages:

Step 1: Understand Your Rights

Knowing your rights is the first step in addressing unpaid wages. Laws at both federal and state levels provide protections against wage theft, ensuring you are paid for all hours worked, including overtime. This foundational knowledge will help you determine if your situation qualifies for pursuing an average settlement for unpaid wages.

If you suspect a violation, research the specific laws that apply to your situation, such as the Fair Labor Standards Act (FLSA), which covers wage and hour standards. Understanding these can empower you to advocate for yourself or seek assistance effectively.

Step 2: Gather Documentation

Documenting all relevant details of your employment is crucial. Keep records of hours worked, pay received, and any communications with your employer about your pay. This documentation can serve as evidence in your claim and demonstrate the extent of the unpaid wages.

Be sure to organize your documents to clearly show discrepancies between the work performed and the compensation received. Detailed records strengthen your case when negotiating a settlement or presenting your claim legally, aiming for the best possible outcome regarding an average settlement for unpaid wages.

Step 3: File Your Claim

The next step is to file your claim for unpaid wages formally. This might involve submitting a complaint to the U.S. Department of Labor’s Wage and Hour Division or a similar state agency. They can investigate the claim and enforce payment if your employer is at fault.

Alternatively, consulting with an employment lawyer can guide the best action, whether directly negotiating with your employer or proceeding to court. Sparrow, a platform specializing in class action discovery, can also help you claim funds from such settlements.

Key Takeaway

Actively pursuing unpaid wages is vital for workers who suspect they have not been fully compensated. Employees often miss out on significant sums due to perceived risks in joining class action lawsuits. Understanding your rights and the potential benefits can change this. The average settlement for unpaid wages varies, but staying informed helps you make the right choice.

Effectively managing your settlement claims is key to accessing the unclaimed money often left behind in class action settlements. With the average settlement for unpaid wages continuing to be a significant issue, ensuring you are proactive in managing your claims can make the difference between recovering your lost wages and missing out.

Are you also involved in an MLS real estate seller lawsuit? Sparrow is designed to assist you in claiming funds from various class action settlements. Platforms like Sparrow can simplify this process, offering tools and support to help track and file your claims efficiently.